Bookkeeping can be time consuming for business owners. Here are five easy ways to save time bookkeeping.

1. Never record sales in a word processor. Though word processors may provide more options for invoice templates it creates a double up of work. If you are using accounting software it is definitely worth the time to setup an invoice template to record your sales. It saves you time because each time you create an invoice in the accounting software you record your sale as well. You may not be able to get the exact colour or layout of the invoice that you prefer but the time saved is definitely worth the trade off.

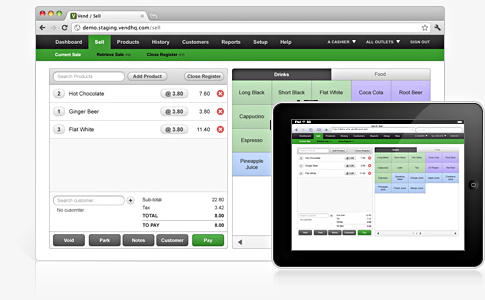

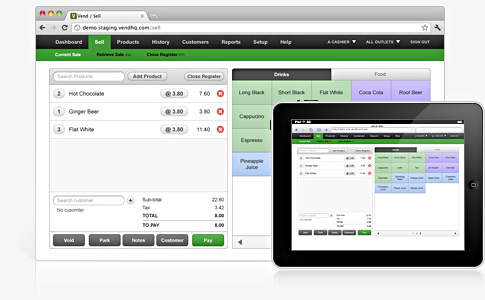

2. Integrate your point-of-sale system with your accounting software. This is a huge time saver for retail businesses. Each time your process a sale through your point-of-sale system it does the necessary entries into your accounting software. No need to enter in daily sales totals or movements of inventory. Accounting software like Xero is perfect for this as it has loads of add-ons including point-of-sale software.

3. Don’t use old school docket https://onhealthy.net/product-category/antifungals/ books. Handwritten invoices are out of date. Not only do they create double the work for processing sales, they just aren’t cool. If you need write out invoices on the go and you own a smart phone, why not use an invoicing app. These integrate with your accounting software. You simply draft your invoice and email it to your client. The invoice is automatically recorded in your accounting software as sale.

4. Make payments in batches. Set aside time each week for weekly bills or once a month for monthly accounts. Avoid paying bills one by one, as it is very time consuming. Instead create a batch payment file for your accounts payable. Simply upload it to your online banking and your bank will pay all your bills at once.

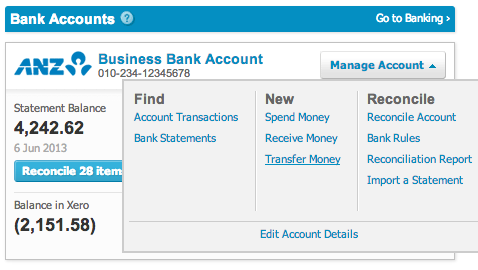

5. Use bank feeds. Some accounting software let you use bank feeds. These automatically upload your bank statements into your accounting software. This feature significantly speeds up bank reconciliations. No need to enter the bank statement data into your accounting software anymore.

If you would like more information on any of the topics covered, please feel free to contact us anytime.

WorkflowMax is job, time and invoice management software. It is designed to remove the frustration from job management. WorkflowMax covers all aspects of a job, from lead management to quoting, time sheeting to invoicing and everything in between. If your business is job focused than WorkflowMax is perfect for you.

Timesheets in WorkflowMax are very flexible. They can be completed by individual staff using computers, tablets or smartphones. Use the stopwatch feature for exact minutes or update them daily or weekly. Timesheet hours are billed against jobs to see how many hours have been spent on each job and by whom. Save time by exporting your weekly payroll to leading payroll software such as Xero.

WorkflowMax helps you track each of your jobs with ease. Know how you are tracking against deadlines or job estimate. Track your expect profit on each job. Know exactly who has been working on each job and for how long. Access all this information about your jobs in once central place.

Set overall objectives and deadlines for projects. Break projects into tasks and allocate time and resources for each task. Notifications alert you to upcoming due dates and impending breaches in estimated times. Manage your jobs easily on the run using your smartphone or tablet.

Save time invoicing using WorkflowMax. No need to use a calculator, WorkflowMax will automate invoice calculation with a single click. Bill on staff rates or task rates. Brand your invoice template giving your own look and feel. Write off individual timesheets. Easily mark up materials used. Invoice multiple jobs on the same bill. Invoices can be easily integrated with Xero and other accounting systems.

For more information about WorkflowMax features, integration with Xero and account setup please do not hesitate to contact us.

Most business owners and bookkeepers are conscience to the possibility of cash going missing; few have the same attitude towards keeping stock safe. If you business carries stock that is easily sold for cash, then you will need some additional systems to manage your stock.

1. Split ordering roles from accepting deliveries.

The goal is that the person placing the order for inventory isn’t the same one accepting the delivery of inventory. So the employee in the electronic store doesn’t place an order for an iPad with the intent of taking it home, as the person accepting the delivery receives the iPad and records it into stock.

2. Match bills and delivery dockets.

Only approve bills for payment that have delivery dockets or stock receipts. This quickly highlights if inventory has been ordered but not entered into the inventory management software.

3. Protect stock from being stolen.

Take control of the physical access to your warehouse by employees and suppliers. Only https://diazepamhome.com provide keys to full-time employees, restrict hours of access to the warehouse, and change the alarm passwords when employees resign. Use back to base alarm monitoring so that warehouse is covered 24 hours a day.

4. Identify what inventory items are more likely to be stolen.

For example, if you’re a surf wear retailer you will probably need to be more vigilant about protecting expensive sunglasses and watches than you would about protecting shirts and board shorts. Small expensive items are big targets for thieves.

5. Complete stocktakes regularly and report back to your staff.

Complete stocktakes in regular intervals as these give comprehensive details of the state of your stock. Most stocktakes have discrepancies. Report these discrepancies back to warehouse staff and have the staff involved in tracking down the reasons for the discrepancies.

If your stock is out of control or you want to improve the way your stock is handled, please contact us today and find out how we can help.

Clear your desk and simplify your life with paperless bookkeeping. Imagine not having the stress of paperwork in your small business. Wouldn’t it just make your life easier? It may sound far-fetched but paperless bookkeeping can actually be a way of life.

The introduction to cloud-based accounting software was the starting point to this life. Cloud-based accounting software uses automatic bank feeds. Bank feeds automatically import all of your bank account transactions. No need to print off statements or have them mailed to you. No need to manually enter bank data. Xero is one of more popular cloud-based accounting software products available. It has access to hundreds of banks, credit card facilities, PayPal and over 160 foreign currencies. Not only do bank-feed reduce the time you spend on your books. They eliminate your need of paper bank statements and start you on the journey to complete paperless bookkeeping.

Shoeboxed is a Sydney-based company that scans and organises your receipts, invoices and other documents securely online. Simply send (post or email) all your paperwork into Shoeboxed. Shoeboxed will then https://xanaxcost.com/anxiety-medication-xanax/ extract the data (date, vendor, amount, GST, payment type) from the documents. They then upload and store them in your secure online account. You simply check that they have been allocated to the right account type with the correct GST codes and import them into your accounting software. They can either send all your documents back to you or you can request that they shred them. They will store all your electronic copies online where you will always access them. Shoeboxed will even help you if you ever get audited by providing the Australian Taxation Office with access to your documents.

Cloud-based accounting and Shoxboxed will give you a strong start on your journey to paperless bookkeeping. They will help you simplify your bookkeeping and reduce your stress levels. If you would like to find out even more ways your small business can do paperless bookkeeping, please contact us. At Prestige Bookkeeping Solutions, we pride ourselves on providing bookkeeping innovation and efficiency for all our clients. Check out our bookkeeping services for more detail on how we can solve your bookkeeping needs.

Dealing with petty cash in Xero is simple. There are plenty of different ways to deal with petty cash in your small business. Firstly, it must be clear when it comes to petty cash there are general rules and outcomes that never change:

There are two main ways to manage petty cash in xero, depending on whether you have employees or are an owner operator.

It’s that simple, no more annoying receipts and headaches.

Please feel free to contact us if you would you like more information on our bookkeeping services or Xero bookkeeping.

With the advance of cloud-based software, retail bookkeeping has never been simpler.

Traditionally, each point-of-sale would need software installed and updated, or connected to an expensive computer server. Your customer databases from each shop would always need to be merged. Sales figures exported and then imported into an accounting program. Stock movements in your shop wouldn’t be reflected in your online store. These are just some of the hassles and frustrations of retail bookkeeping.

Thankfully, there is a better way. Cloud-based point-of-sale software such as Vend or Retail Express, are run on a secure web-based server. This means that your computers, tablets or smartphones only need an internet connection to access the point-of-sale software. When the software in the ‘cloud’ is updated, you automatically get access to the updated version. All your point-of-sales are connected to the one centralised program, allowing your customer databases to be merged. This can help improve your customer loyalty programs and marketing.

https://youtube.com/watch?v=mj7bOx660zc%3Ffeature%3Dplayer_embedded

Cloud-based point-of-sale software can be easily integrated into accounting software such as Xero. Sales totals get pushed into Xero for reconciliation with your bank account. Account statements and invoices sent from Vend or Retail Express automatically appear in Xero for reconciliation. Purchase orders enter into your point-of-sale software are forwarded into Xero. You can even merge your customer and supplier databases in both Xero and your point-of-sale software easily.

Add Shopify to the mix for your e-commerce solution to take your retail bookkeeping to a new level. Shopify allows you to sync your products, prices and inventory with your point-of-sale software. This will ensure you never sell a product online that you don’t have in stock. If you decide edit your product prices or descriptions in your point-of-sale software, Shopify will automatically update your online products to match.

If you would like to find a retail bookkeeping solution for your small business please contact us for a free retail bookkeeping consultation. If you would like to know more about the services we offer, check out our bookkeeping services page.

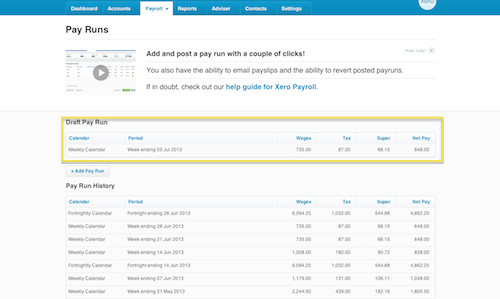

Completing your end of year payroll obligations has never been easier in Xero. You just need to follow these four simple steps

Step 1: Complete all pay runs up to 30 June and ensure they reconcile with the general ledger. Post or cancel any uncompleted pay runs (as shown in the picture below).

Step 2: Check that each employee’s specific pay components have been recorded correctly in payroll.

Step 3: Run the end of year payroll payment summaries.

Step 4: Send end of year payroll information to the ATO.

Your finished until next year! Should you have any questions about our bookkeeping services or end of year payroll in Xero please do not hesitate to contact us.

The start of the new financial year has come and gone, so its time to complete your year-end bookkeeping. If you are like most small businesses, you have work to do to get your books ready for your accountant. Having your year-end bookkeeping as accurate as possible aids in the speed of the preparation of your return. This means not only faster turn around for your tax return but cheaper too.

Here are five key items to check in your year-end bookkeeping prior to having your tax completed.

If you need any more help getting your year-end bookkeeping complete, please don’t hesitate to contact us.