Completing your end of year payroll obligations has never been easier in Xero. You just need to follow these four simple steps

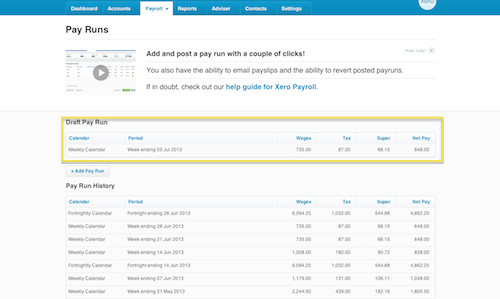

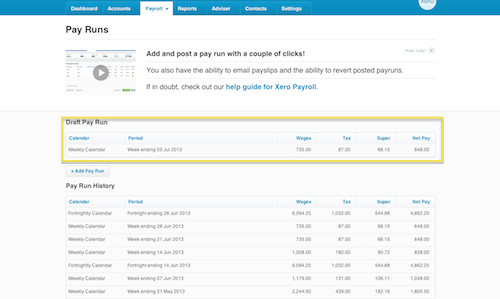

Step 1: Complete all pay runs up to 30 June and ensure they reconcile with the general ledger. Post or cancel any uncompleted pay runs (as shown in the picture below).

- Once you have completed the final pay run for June, check that your total earnings, superannuation and PAYG reconcile to your accounts. To do this go to ‘Reports’ and select the ‘Payroll Activity Summary’ report. Change the date range to ‘This Financial Year’.

- Take note of your end of year payroll accounts (earnings, tax & super). Compare these figures with the ‘General Ledger’ report for the same date range.

- If you have been using more than one wage account you will need to add these up to see if they match the ‘Payroll Activity Summary’ report.

- When comparing the tax we want to only look at the credit column as this represents the total liability for the year excluding the payments we have already made.

- If you have discrepancies with any of your end of year payroll amounts, you will need review your payroll and correct these differences before you proceed to step 2.

Step 2: Check that each employee’s specific pay components have been recorded correctly in payroll.

- To do this go to ‘Reports’ and select the ‘Payroll Activities Details’ report. Change the date range to ‘This Financial Year’.

- Review the information for each employee. If any of their end of year payroll amounts are incorrect or are in this wrong area, you will need to correct them. Go to the Xero Help Centre to learn how to correct these errors.

Step 3: Run the end of year payroll payment summaries.

- To do this go to ‘Payroll’, ‘Employees’ and select ‘Payment Summaries’.

- Check that your organisation name, ABN and postal address are correct. If they are wrong, go to ‘Organisation Settings’ to update them.

- Enter the Signatory (Usually the business owner or payroll administrator). This name will be printed out on the payment summaries as the authoriser.

- Provide a phone number that the ATO can contact you on if they need to get any more information from you.

- When finished, select ‘Confirm and Continue’.

- Check the financial year is correct and record any reportable fringe benefit or lump sum amounts.

- Reportable fringe benefit amounts can be found on your reportable fringe benefits tax return.

- If you paid employees lump sum amounts during the year, you should have created a pay item for these. You can find these in the ‘Transaction Listing Details’ report under ‘Reports’.

- Once finished, select all the employees and ‘Publish’. Publishing locks the end of year payroll accounts down and publishes payments summaries to the employee portal so that your employees will have access to them.

- If you prefer to print or email the payment summaries to your employees, select ‘Send to Employee’

Step 4: Send end of year payroll information to the ATO.

- On the same screen, select ‘Create EMPDUPE’

- If you are preparing the end of year payroll information on behalf of another business, select ‘Yes’ to supply contact details to the ATO. If you don’t need to supply contact details, then select ‘No’.

- Once the EMPDUPE file is created, you need send it to the ATO.

- You can either, upload it to the ATO online portal, submit it via ATO ECL software or submit it on a storage device (e.g. USB stick or CD).

Your finished until next year! Should you have any questions about our bookkeeping services or end of year payroll in Xero please do not hesitate to contact us.

Passionate about small business, cloud technology & travelling the world.