Dealing with petty cash in Xero is simple. There are plenty of different ways to deal with petty cash in your small business. Firstly, it must be clear when it comes to petty cash there are general rules and outcomes that never change:

- Purchases have to be related to your small business.

- If someone takes money from the tin and promises to bring back a receipt, they probably won’t.

- When someone puts an IOU in the petty cash tin. It means they won’t pay you back.

- No matter how strict you are, petty cash will never balance.

There are two main ways to manage petty cash in xero, depending on whether you have employees or are an owner operator.

Petty Cash in Xero with Employees

Setup your petty cash system using these five steps:

- Buy a petty cash box with a lock and key.

- Assign a gatekeeper for the petty cash tin.

- Set an amount to be used as a float.

- Have your gatekeeper keep your employees accountable to return receipts and change.

- When the petty cash tin is low on funds. Sort the receipts and go to the bank and top it up to original float amount.

Setting up petty cash in Xero:

- Setup a bank account that will represent the transactions in the petty cash tin. You do this by clicking the ‘add bank account’ button in the chart of accounts settings. Enter your petty cash tin balance into Xero in the conversion balance settings. Whenever you restock the petty cash tin.

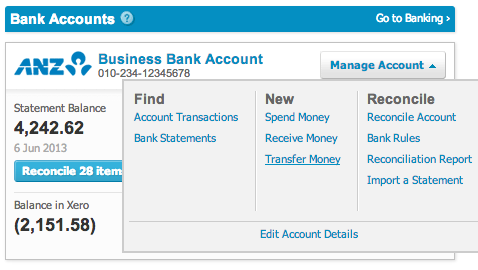

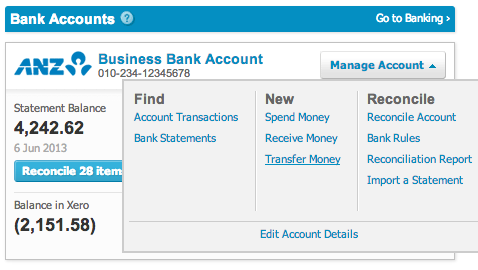

- Click the ‘Manage Account’ button in Xero of the appropriate bank account (as shown in picture below). Click the ‘Transfer Money ‘ button to account for the transfer of money into your petty cash tin.

- To record transaction that occur in your petty cash tin, use the ‘Manage Account’ drop down box again. Select ‘Spend Money’ or ‘Receive Money’ and enter in the appropriate details.

- When you want to reconcile the account, use the ‘Manage Account’ drop down box and select ‘Reconcile Account’. Since there is no bank feed attached to this account, simply tick all items entered and select ‘Mark as Reconciled’ which will update your actual bank balance figure.

Petty Cash in Xero for Owner Operator.

For owner operators, tracking petty cash in xero is even easier:

- Download the Xero app for your smart phone, iPhone or Android.

- Each time you make a purchase with personal cash or electronic funds ask for a tax receipt.

- Enter in the purchase in the Xero app as an expense claim. The app allows you to take a photo of the receipt and allocate the expense to the appropriate account in Xero.

- You can now discard the receipt as Xero will save its photo with the transaction online.

- When it’s time to reimburse yourself. Log into Xero and approve and pay all the expense reimbursements you have entered. If you want to leave the money in the business just allocate the reimbursement to “Owners Funds Introduced’. This will keep track of how much personal money you have used in the business and allow you to claim the GST credits for those purchases.

It’s that simple, no more annoying receipts and headaches.

Please feel free to contact us if you would you like more information on our bookkeeping services or Xero bookkeeping.

Passionate about small business, cloud technology & travelling the world.